Navigating the Market Pullbacks: Insights and Strategies for a Bullish Future 2024

We enter the “not so exciting” part of the bull market. Because after gains so fast and furious, we are now seeing a lot of pullbacks, sector rotations, and overall volatility.

Market Outlook: Understanding Current Economic Trends

Unfortunately, this is exactly what I expect to happen in next year’s diet in line with the overall results of Year 3 of the bull market. That’s because when the simple gains bounced off the bear market floor…then investors need to do some more soul searching on what to buy next as the S&P 500 (SPY) usually comes in around breakeven.

Glad if you know it’s coming…it’s easier to stomach it and easier to pick good stocks and plan your way to market gains. All that and more will be discussed in today’s Reitmeister Total Return presentation.

Market Outlook

On most degrees the economic reviews have are available as expected. That is a gentle touchdown increase price among 1-2% GDP with inflation readings continuing to ebb decrease.

Then on Friday the Government Employment Situation got here in approximately as predicted at 142,000 jobs brought. What changed into eye popping approximately the record become the higher than expected 0.Four% month over month increase for Average Hourly Earnings (aka Wages). This sticky shape of inflation remains some distance too sticky with the 12 months over yr stage growing from 3.6% to three.8%.

Economic Growth and Wage Inflation: Impacts on Investment Strategy

Yes, increasing inflation in wages is NOT what the Fed wants to see at this factor. Bond traders nevertheless are looking for one hundred% threat of a price reduce at the following Fed assembly on September 18th, but the odds have shifted again meaningfully closer to a smaller 25 basis factor cut rather than 50.

I agree that this nevertheless burning ember of wage inflation can have the Fed be extra cautious with a smaller reduce at the subsequent meeting. The more curious question is the tempo of cuts that comply with. No doubt upcoming inflation reviews may have a outstanding deal to do with that which include:

Sept. 11 CPI , nine/12 PPI , 9/27 PCE

10/4 Government Employment Situation (with eyes focused on that Average Hourly Earnings element).

Price Action

Average: 50 days (yellow) @ 5,505 > 100 days (orange) @ 5,388 > 200 days (yellow) @ 5,157

There was a pretty brutal correction in August with breaks below 50 and 100 days…but still 200 was never really in jeopardy. Maybe the logic is also true this time because I just don’t see the motivation for falling like that.

Mr. Market, on the other hand, can do whatever he wants…whenever he wants with little rhyme or logic. Therefore, it should be under the heading “things you have”.

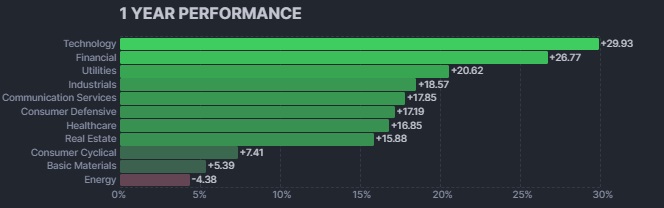

More interesting is how the page is turned down. Let’s start with a 1-year performance snapshot for each company: This is a very bullish picture with technology, finance and technology charging ahead. But now let’s look at the last 3 months:

This is a very strong defensive rotation with utilities, consumer defensives and healthcare being the top performers. The other 2 top categories, Real Estate and Financials, are doing well because the rate drop is highly beneficial for both categories.

In addition, the Risk On and high-income categories follow. Namely, energy, fundamentals, customer cycles and yes, technology.

Price Action Analysis: Trends and Patterns

I wouldn’t say it means the tide is changing, get ready for the next bear market. Only annoying additions in Risk Off categories.

I expect the more dovish the Fed seems to be from their 9/18 meeting…the more housing will be on track for the economy…the higher GDP and income.. .the more likely people are to return to these many Risk On businesses groups.

One caution to note is that valuation does matter at this point in a bull market. Thus, investors can be more selective about what to buy going forward.

Moving Averages: A Technical Perspective

I think it will be a healthy combination of earnings growth combined with fair valuation. Those are the stocks from our POWR Ratings analysis of 118 key factors.

The highlight of what happens next in the Sept. 18 Fed meeting. Until then, I cared little about the noise and fluctuations of the market. Stocks that fall big on pullbacks will also hit big during the next bull run.

Like a bull rider, you have to hold on tight to avoid throwing.

This Stock Market is NOT FUN!

Explore my current portfolio of 11 stocks with outstanding gains I have made in our exclusive POWR ratings model. (Almost 4X better than the S&P 500 going back to 1999).

All of these handpicked picks are all based on my 44 years of investing experience watching bull markets…bear markets…and everything in between.

And now this portfolio is blowing the stuffing out of the market.

To learn more, and to see my 11 timely stock recommendations, please click the link below to get started now.